The Great Bitcoin Power Grab

Morgan Stanley Analyst's State that Cryptocurrency Mining Could Reach Up To 140 Terawatt-Hours in 2018

The vast amounts of power required by the Bitcoin and other cryptocurrency mining operations is reaching a feverish pitch.

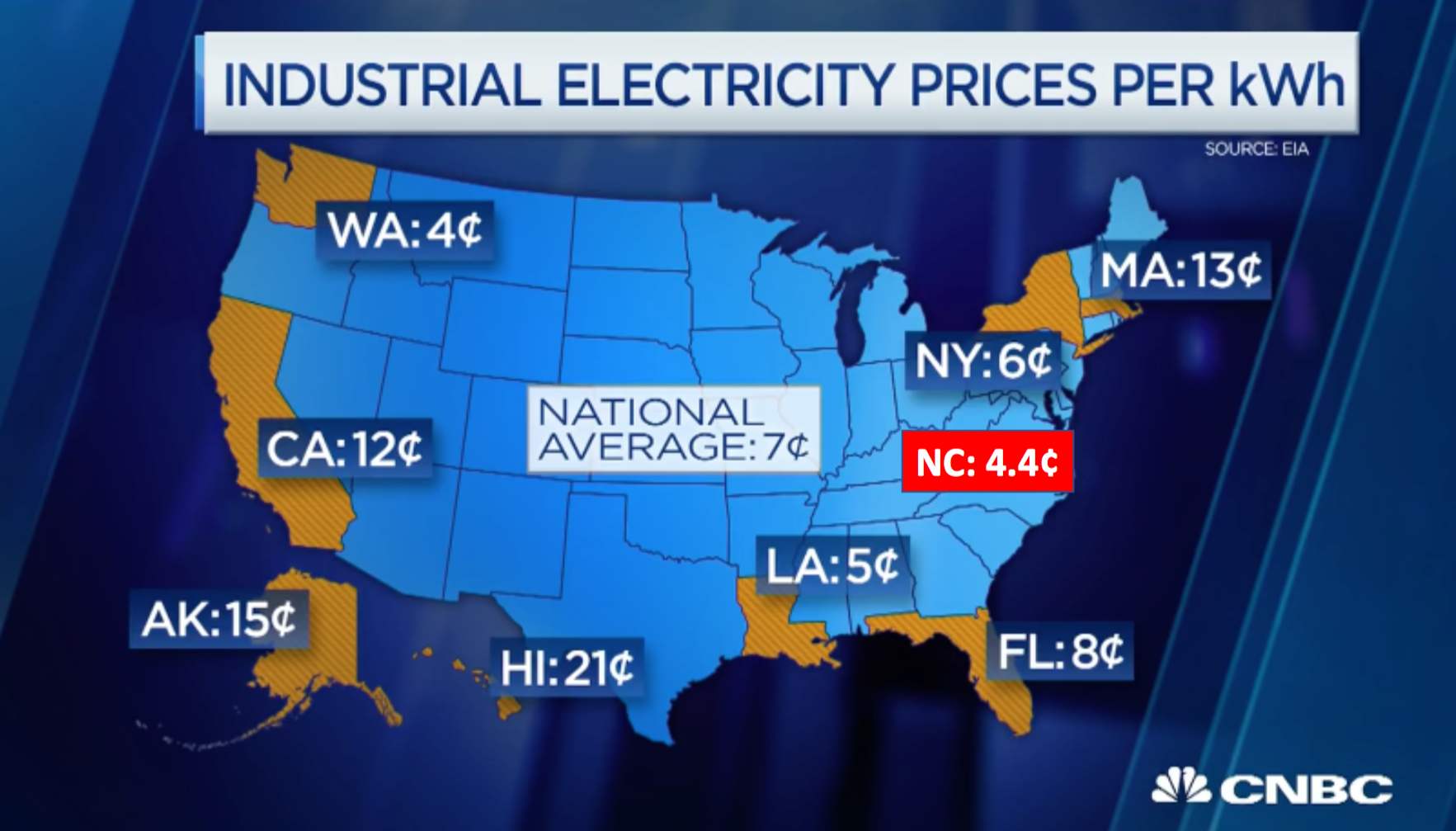

Industrial electricity rates and power availability in certain areas of the US are a hot topic these days and the search for low power rates has switched into high gear as the value of Bitcoin and other cryptocurrencies have increased dramatically over the past year.

The search for cheap power has long been pursued by data centers and other power-driven industries as the cost of power is often the highest consistent operational cost for many high-power load industries. As these cryptomining companies continue to absorb huge amounts of power to run their facilities, there is a rabid search for low power rates and near-term availability. Hundreds and hundreds of MWs of power is in play in 2018.

Washington State has witnessed a big increase in mining operations with several hundred MWs of power being consumed by miners. Washington has a low cost, hydro-electric power profile offering power rates almost 50% less than the national average. Central US offer several options for low cost of power and has been a driver of some of the larger data center deployments over the past few years.

Additionally, North Carolina has become a target for new large mining facilities with a recent 250,000 SF 50 MW facility opening in Q1 2018. North Carolina's stable climate, low cost of power, and renewable power blend drove some of the world's biggest technology companies to open massive data centers in the western region of the state including Apple, Google, & Facebook over the past several years.

Industrial power rates average 7¢ per kWh nationwide. Lower cost states include Washington State at 4¢ per kWh, Louisiana at 5¢ per kWh and North Carolina at 4.4¢.

Although power costs are the main driver, utilization of outside cooling or “free cooling” to cool the mining equipment is another determining factor in overall operating costs. The “free cooling” profile of Washington state, Canada and the western region of North Carolina will be factors in the decision-making process of future mining deployments.

All being said, we see large amounts of power being committed to the Bitcoin and Cryptocurrency industry in 2018, unless, of course, the value of these currencies diminishes substantially. The same pursuit of low cost power by the data center industry will create some urgency in the site selection process.