Private Equity Bets On AI Gold Rush with Billions Pumped into Data Centers

Private equity firms are seeking payoffs from their investments in the data centers that power high-profile AI systems

The financial rewards promised by bets on artificial intelligence have grabbed investor attention, but private equity appears to be more attracted to datacenters that house the computing capacity enabling AI.

The strategy could be described as a picks-and-shovels investment amid an AI gold rush. Private equity remains the dominant force in datacenter M&A, drawn by a growth trajectory expected to persist through both good and bad economic times and now supercharged by the proliferation of AI.

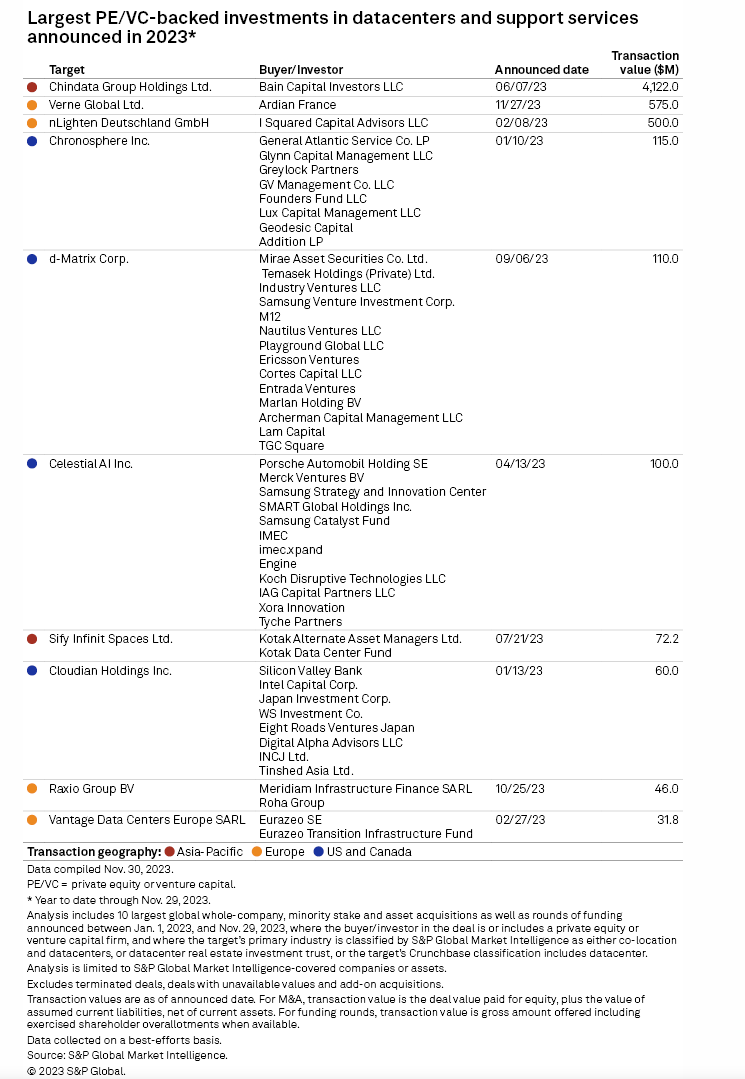

Attractive investment attributes of datacenters include a robust growth forecast, a steady line of customers providing visibility to future revenues and energy costs typically passed on to facility users, not owners, said Pauline Thomson, head of data science for French private equity firm Ardian. Thomson is also a director on the infrastructure team at Ardian, which in November signed a $575 million deal to acquire datacenter platform Verne Global Ltd.

"It ticks all the boxes of an infrastructure asset," Thomson said.

'Enter private equity'

In the face of escalating demand, public datacenter companies are unwilling or unable to invest the tens of billions of dollars required to build new facilities, said John Dinsdale, chief analyst and research director for Synergy Research Group Inc.

"Even if the public data center companies could theoretically fund their own future growth, oftentimes they are not willing to put the resulting pressure on their balance sheets. Enter private equity," Dinsdale said in an email.

Private equity datacenter acquirers have outspent public sector competitors every year since at least 2020, according to Synergy Research. However, M&A overall has slowed this year, impacting datacenter deals as well.

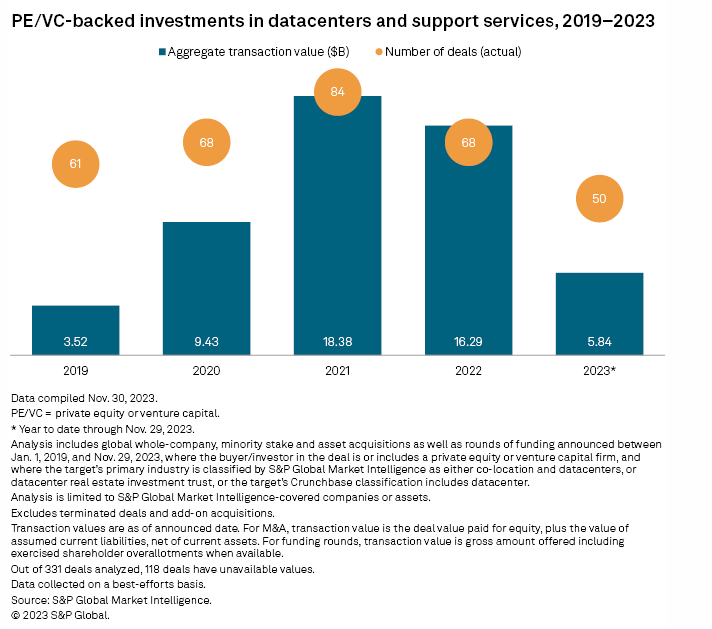

S&P Global data shows that the value of private equity and venture capital investments in datacenters and related services and technology are on pace for their lowest annual total since 2019. The 50 investments recorded globally between Jan. 1 and Nov. 29 came in at about $5.84 billion, less than half the $16.29 billion full-year 2022 total.

A spate of blockbuster deals sent private equity datacenter investment totals soaring in 2021 and 2022. Two take-private deals from last year rank among the largest data center deals ever, according to Synergy Research Group: KKR and Global Infrastructure Partners LP's $15 billion acquisition of datacenter real estate investment trust CyrusOne Inc. and DigitalBridge Group Inc. partnering with IFM Investors Pty. Ltd. on the nearly $11 billion acquisition of Switch Inc., a company that designs, builds and operates some of the world's largest datacenters.

By comparison, the largest deal this year through November was Bain Capital Investors LLC's $4.12 billion take-private of datacenter operator Chindata Group Holdings Ltd. The absence of $10 billion-plus deals in 2023 means the value of private equity dealmaking in the space is expected to take a big step down year over year, Dinsdale said.

AI drives growth

Cloud computing had been the driver of datacenter demand for a decade as businesses and other enterprises shifted to off-premise data storage and processing. AI is not cannibalizing or replacing existing demand for datacenter space; it is stacking right on top, said Waldemar Szlezak, a partner on the infrastructure team at KKR & Co. Inc.

For example, newly built hyperscale datacenters, which are large facilities that can ramp up or down based on demand, will require substantial capital for expansion. Based on recent advances in artificial intelligence and the energy required to run AI computations, the facilities are expected to double current average power capacity over the next six years, according to an October Synergy forecast report.

"There will also be some degree of retrofitting existing data centers to boost their capacity. The overall result is that the total capacity of all operational hyperscale data centers will grow almost threefold in the next six years," the report stated.

Demand for datacenter space is scaling so rapidly that some clients are now securing the space they do not expect to need for up to five years, according to KKR's Szlezak.

"Customers are putting their money where their mouth is," he said.

Energy and location tradeoff

The speed of facility expansion is complicating efforts to secure suitable datacenter locations and, crucially, access to power, especially from less-polluting renewable sources.

Ardian's acquisition of Verne Global was motivated in part by an ambitious plan to build datacenters in Nordic countries, where it can more easily access renewable energy sources like hydropower, Thomson explained.

"What's important to know about AI is it's going to require huge needs, in terms of energy, and it's going to come into scrutiny because of this. We don't necessarily realize when we ask a question to ChatGPT the amount of energy that is behind our ask," she said.

Proximity to end-users becomes a factor in energy use. For datacenters that serve AI models in the training phase, when latency — or the time it takes data to move across a network, which increases with geographic distance — may not be a top concern. But that shifts once AI models are trained and ready to solve problems that arise from real-time data, requiring facilities closer to major metropolitan areas.

That raises one concern that KKR's Szlezak said should be on the mind of datacenter investors: As AI technology evolves, data center owners will have to find new uses for huge, remotely located facilities.

"Once you build these facilities in the middle of nowhere, what happens [next]?"